Notifications

Notifications

24

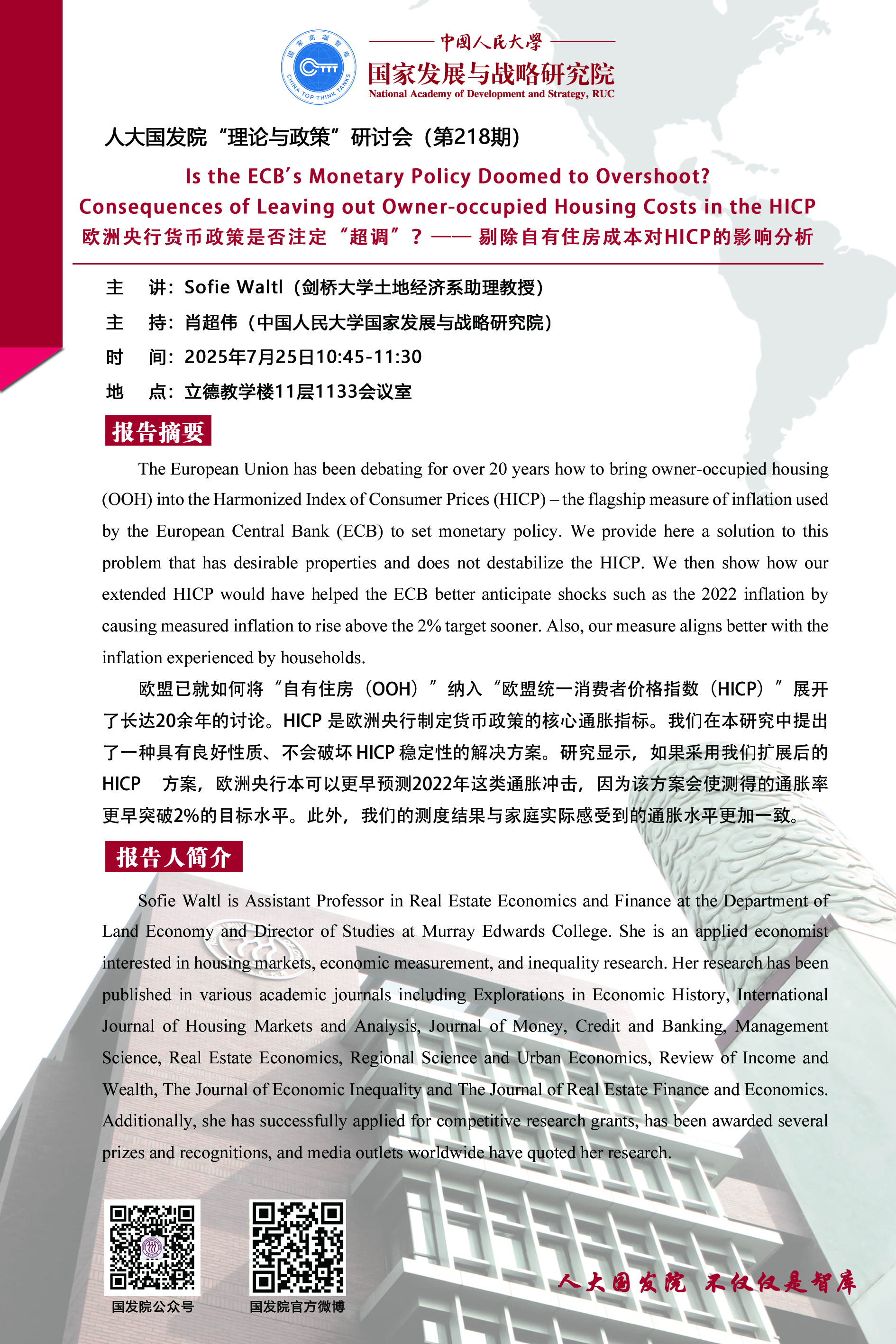

JunNational Academy of Development and Strategy (NADS), RUC

Theory and Policy Seminar, Series 218

Is the ECB’s Monetary Policy Doomed to Overshoot? Consequences of Leaving out Owner-occupied Housing Costs in the HICP

Reported by: Sofie Waltl (Department of Land Economics, Cambridge University)

Moderator: XIAO Chaowei (National Academy of Development and Strategy, Renmin University of China)

Time: Jul 25, 2025 10:45-11:30

Venue: Room 1133, 11th Floor, Lide Building

Abstract:

The European Union has been debating for over 20 years how to bring owner-occupied housing (OOH) into the Harmonized Index of Consumer Prices (HICP) – the flagship measure of inflation used by the European Central Bank (ECB) to set monetary policy. We provide here a solution to this problem that has desirable properties and does not destabilize the HICP. We then show how our extended HICP would have helped the ECB better anticipate shocks such as the 2022 inflation by causing measured inflation to rise above the 2% target sooner. Also, our measure aligns better with the inflation experienced by households.