Research Update

Research Update

27

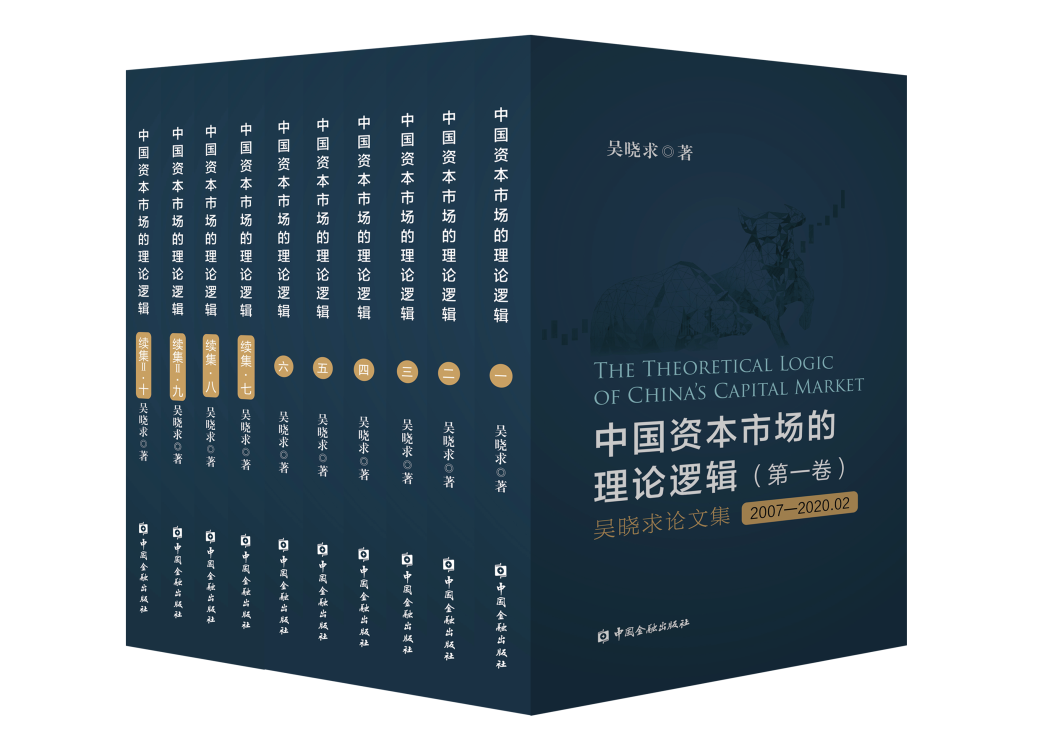

MarUnderstanding the Theoretical Context of China’s Capital Market — The Ten-volume Series The Theoretical Logic of China’s Capital Market by Professor WU Xiaoqiu Completed

Since the launch of China’s reform and opening-up (in 1978), the country’s capital market has undergone a complex and challenging development process — marked by twists and turns, yet ultimately remarkable and brilliant. Authored by renowned financial scholar Professor Wu Xiaoqiu and published by China Financial Publishing House, The Theoretical Logic of China’s Capital Market (a ten-volume series, hereinafter referred to as The Theoretical Logic) presents a unique perspective, profound reflections on finance and the capital market, and independent research. Focusing on the reform and development of China’s capital market, this monumental work not only embodies Professor Wu Xiaoqiu’s academic thought, but also serves as a theoretical summary of the development process and a forward-looking vision for the future of China’s capital market.

Professor Wu Xiaoqiu: “My lifelong dream is to build China’s capital market into a major wealth management center for RMB-denominated assets and a global international financial center”.

Professor Wu Xiaoqiu is a renowned financial scholar in China and a National First-Class Professor. He previously served as Vice President of Renmin University of China and is currently the Dean of the National Academy of Financial Research and the Dean of the China Capital Market Research Institute at Renmin University of China. In addition, he serves as the convener of the Appraisal Group for Applied Economics under the Academic Degrees Committee of the State Council, and as the Deputy Director of the National Steering Committee for Graduate Education in Finance.

“I believe my entire life has been dedicated to the cause of China’s capital market,” he once said with deep emotion in an academic lecture. His lifelong dream is to build China’s capital market into a key wealth management center for RMB-denominated assets and a global international financial center.

Over the past three decades, Professor Wu Xiaoqiu has devoted himself to the study of financial theory and capital markets, achieving remarkable accomplishments in the field. He has published more than one hundred papers in leading academic journals such as Social Science in China, Economic Research Journal, Journal of Financial Research, and Manage World, offering profound insights into the dynamics of financial markets.

In recent years, he has authored a series of influential Chinese-language works, including Chinese Capital Market in the Past 30 Years: Exploration and Reform (2021), China’s Capital Market: The Third Mode (2022), The Logic of Capital Market Development (2023), Elemental Analysis of Valuation Theory System in Chinese Capital Market (2024), and Financial Powerhouse: The Path of China (2025).

His English-language publications have also received widespread acclaim, notably Chinese Securities Companies: An Analysis of Economic Growth, Financial Structure Transformation, and Future Development (Wiley, 2014) and Internet Finance: Logic and Structure (McGraw-Hill, 2017).

The Theoretical Logic consists of ten volumes, completed in February 2025, totaling approximately 3.5 million words. The collection encompasses Professor Wu Xiaoqiu’s academic papers, scholarly commentaries, professional speeches, and significant interviews spanning from 2007 to 2024. Throughout the compilation process, Professor Wu adhered to the principles of fidelity to the original work and preservation of its original intent. He carefully revised and standardized the texts, particularly the transcripts of speeches and interviews, striking a balance between maintaining their immediacy and enhancing their academic rigor.

Volumes 1 through 6 are divided into four sections — “Collected Papers,” “Commentaries,” “Speeches,” and “Interviews.” These volumes include representative academic papers, commentaries, forum speeches, and interview transcripts from 2007 to March 2020. The core theme is the theoretical logic behind the development of China’s capital market. In addition, they present in-depth reflections on financial structure, financial risk, financial regulation, internet finance (fintech), macroeconomics, higher education, and talent development. Among these, Volume 1 (“Collected Papers”) and Volumes 3, 4, and 5 (“Speeches”) highlight the author’s professional research achievements and his concerns and judgments on major issues and trending topics. Volume 2 (“Commentaries”) and Volume 6 (“Interviews”) serve to explain and supplement these perspectives, enabling readers to more comprehensively understand the author’s academic thought.

Volumes 7 and 8 are a continuation of the first six volumes, mainly featuring papers, commentaries, professional interviews, and academic speeches from April 2020 to May 2022. Structurally, they follow a similar framework, continuing to focus on the theoretical logic of China’s capital market development, while also covering topics such as financial structure, financial technology, financial risk, financial regulation, and macroeconomic issues. In particular, Volume 8 (“Speeches”) more directly and forcefully conveys the author’s theoretical propositions and policy recommendations on financial reform and capital market development.

Volumes 9 and 10 further extend the previous eight volumes, collecting academic papers, short commentaries, important interviews, and representative speeches delivered between July 2022 and December 2024. These volumes maintain the focus on financial development and capital market reform, while also offering in-depth analysis of broader economic issues in China. Notably, the “Speeches” section in Volume 10, with its vivid language and sharp insights, articulates the author’s theoretical views and policy positions on key issues facing China’s capital markets.

(Translated by ZHANG Yuqing; Proofread by YANG Fanxin)