Notifications

Notifications

18

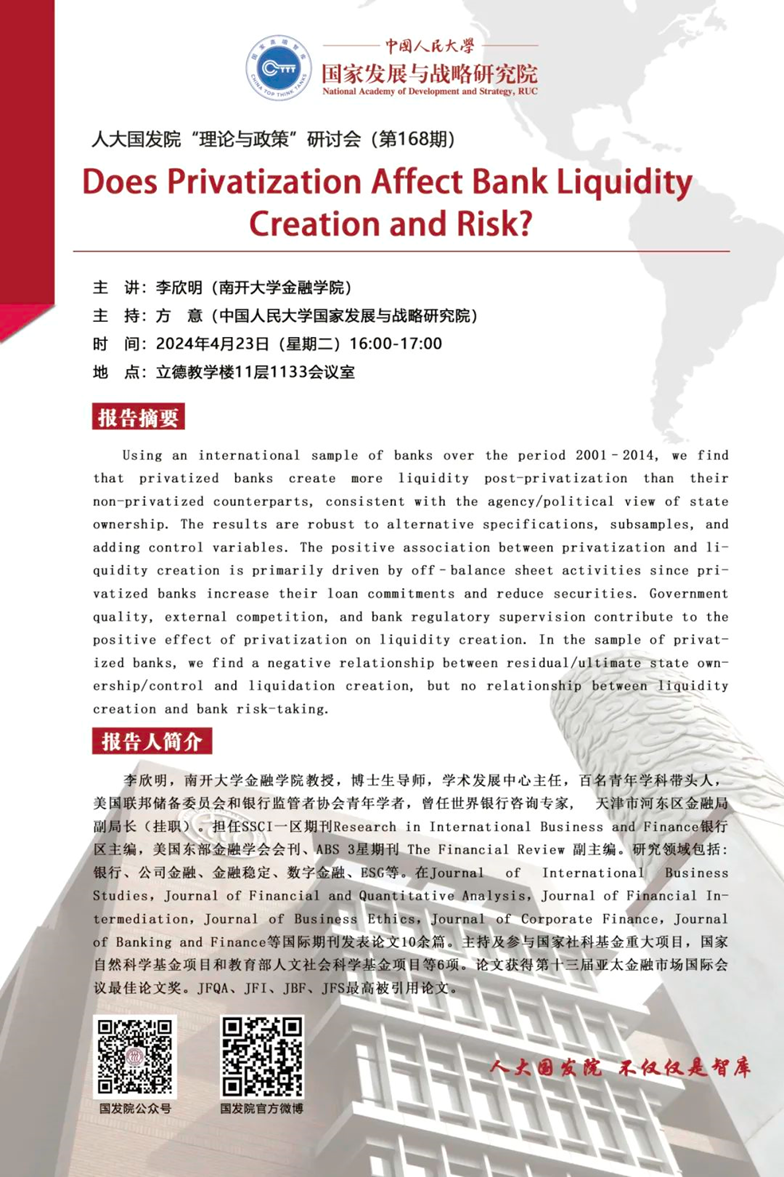

AprNational Academy of Development and Strategy (NADS), RUC

Theory and Policy Seminar, Series 168

Does Privatization Affect Bank Liquidity Creation and Risk?

Reported by: LI Xinming (Associate Professor at School of Finance at Nankai University)

Moderator: FANG Yi (Professor at National Academy of Development and Strategy, RUC)

Time: April 23, 2024 (Tuesday) 16:00-17:00

Venue: Room 1133, 11th floor, Lide Building

Abstract:

Using an international sample of banks over the period 2001–2014, we find that privatized banks create more liquidity post-privatization than their non-privatized counterparts, consistent with the agency/political view of state ownership. The results are robust to alternative specifications, subsamples, and adding control variables. The positive association between privatization and liquidity creation is primarily driven by off–balance sheet activities since privatized banks increase their loan commitments and reduce securities. Government quality, external competition, and bank regulatory supervision contribute to the positive effect of privatization on liquidity creation. In the sample of privatized banks, we find a negative relationship between residual/ultimate state ownership/control and liquidation creation, but no relationship between liquidity creation and bank risk-taking.