03

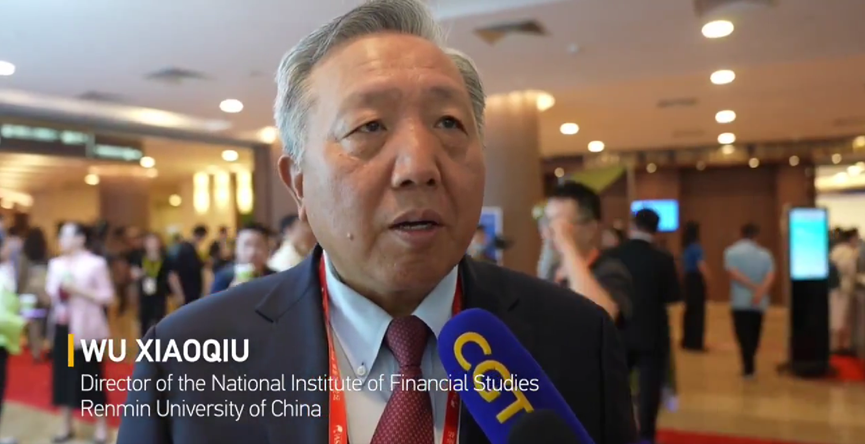

AprAs China’s A-share market once again dips below the 3000-point mark, Wu Xiaoqiu, Director of the National Institute of Financial Studies at Renmin University of China, emphasized the need to prioritize stabilizing confidence from the Chinese capital market to the overall economy.

Speaking at the Boao Forum for Asia Annual Conference held in Hainan on Wednesday (March 27), Wu Xiaoqiu expressed cautious optimism regarding China’s target of achieving 5% economic growth this year. He noted that China faces internal economic structural transformations, adjustments in its economic operational model, and significant external uncertainties. While acknowledging a promising future, he stressed the importance of addressing current issues and avoiding blind optimism.

He outlined three necessary adjustments for the Chinese economy. Firstly, instilling confidence and expectations among investors, consumers, entrepreneurs, and all market participants. Secondly, deeply understanding the changes in China’s economic operational model, emphasizing the end of the era of expansive growth and overreliance on government officials, and the transition to a normal and regulated market economy.

Furthermore, China must shift towards driving economic development through institutions rather than policies. Wu Xiaoqiu argued that attempting to achieve long-term economic stability through policy adjustments is unrealistic, as policy fluctuations lead to significant rent-seeking and speculation. He highlighted the importance of improving institutions over frequent policy adjustments.

Using the day’s A-share market trends as an example, Wu Xiaoqiu underscored that China’s capital market is once again being tested, emphasizing the primacy of consolidating confidence. He cautioned against complacency and stressed the fragility of confidence. In the long term, he advocated for institutional reforms, emphasizing that the market is fundamentally about wealth management and investment rather than financing. (Translated by ZHANG Yuqing, Proofread by YANG Fanxin)