Research Update

Research Update

28

MarchPolitical Risk Assessment Report of the “Belt and Road” Energy Investment 2019 was compiled by Center for Energy and Resource Strategic Studies of NADS, RUC.

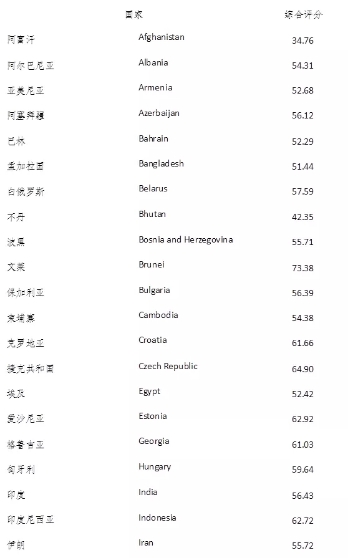

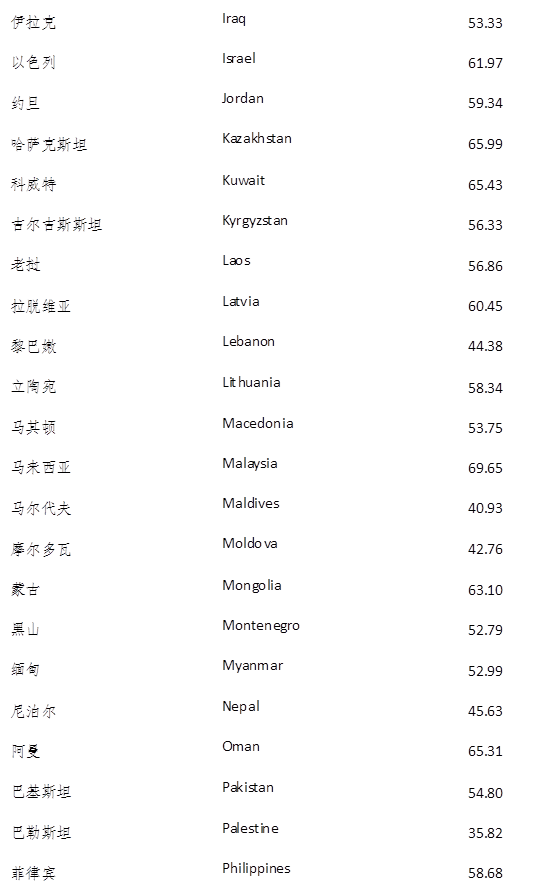

The report assessed the risks of BRI energy investment from six dimensions: the economic base, social risk, political risk, China-related factors, energy factor, and environmental risk. Two new sub-indicators of “whether signed bilateral currency swap agreements with China or not” and “whether signed BRI MOU with Chinese government or not” were taken into consideration by the report because these two factors reflected the close relationships between China and the country in BRI investment and cooperation. The report also optimized the calculation method of environmental risk by using EPI evaluation to measure the level of environmental governance.

The result shows that in 2019, 3 countries are with the lowest risk in terms of energy investment, 20 with lower risk, 30 with medium risk, 7 with higher risk, and 4 with the highest risk. More details are shown as below:

3 countries are with the lowest risk: Singapore, UAE, Brunei.

20 countries are with lower risk: Malaysia, Qatar, Saudi Arabia, Kazakhstan, Kuwait, Oman, Czech Republic, Romania, Poland, Vietnam, Mongolia, Estonia, Indonesia, Russia, Israel, Thailand, Croatia, Slovenia, Georgia, Latvia.

30 countries are with medium risk: Slovakia, Serbia, Hungary, Jordan, Philippines, Turkey, Lithuania, Belarus, Laos, Turkmenistan, India, Bulgaria, Kyrghyzstan, Azerbaijan, Sri Lanka, Iran, Bosnia and Herzegovina, Pakistan, Ukraine, Cambodia, Albania, Macedonia, Iraq, Myanmar, Republic of Montenegro, Uzbekistan, Armenia, Egypt, Bahrain, Bangladesh.

7 countries are with higher risk: Tajikistan, Nepal, Lebanon, Timor-Leste, Moldova, Bhutan, Maldives.

4 countries are with the highest risk: Yemen, Syria, Palestine, Afghanistan.

Compared with the assessment in 2018, there is a decline in the number of countries with higher and the highest political risk, and an increase in countries with lower and the lowest political risk. The reasons behind are rebound in price of energy commodities since 2017, recovery of global economy and overall stability of international politics. Regionally speaking, investment risk in Middle/Eastern Europe and Southeast Asia is low, in the Post-soviet region, South Asia, West Asia, and North Africa is relatively high.

Attachment: scores of BRI energy investment risk in different countries (1-100)